Fha manufactured home loan calculator

Because this type of loan. It is the largest insurer of mortgages in the world insuring over 34 million properties since its inception in 1934.

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Since CalHFA is not a direct lender our mortgage products are offered through private loan officers who have been approved trained by our Agency.

. An FHA Title I loan can be used for refinancing a manufactured home as well as purchasing one. The USDA home loan also requires zero down payment and offers similar rates to VA loans. In traveling mode the home is eight feet or more in width and forty feet or more in length These homes are regulated under the rules known as Federal Manufactured Construction and Safety Standards and must be labeled accordingly.

Fixed-Rate Mortgage FRM A mortgage loan in which the interest rate remains the same for the life of the loan. The good news for people that have a manufactured or modular home is that the credit standards and rules are changing for fixed and HELOC loans and cash. Problems with the home valuation.

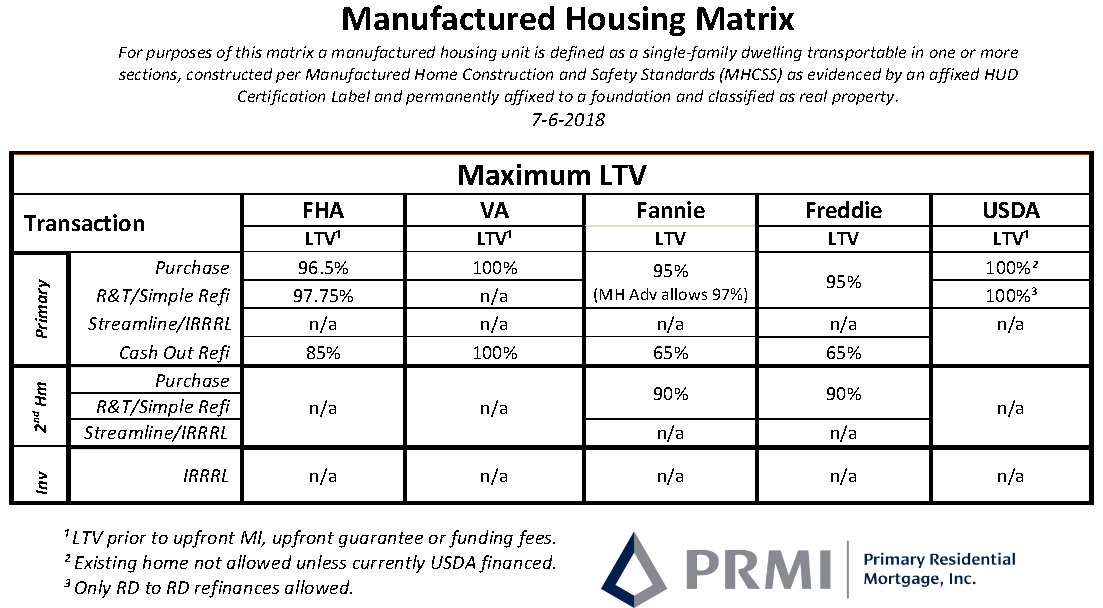

A VA loan can finance up to 100 of the homes value. FHA minimum down payment. FHA minimum credit score.

Maximum loan for home plus land. There are rules that permit a borrower to receive such outside help but the source and purpose of these funds are carefully regulated under FHA mortgage loan rules. To get an FHA loan find a bank credit union or mortgage lender who works with FHA-loans.

A quick look at the features of an FHA Manufactured Home Loan. Nexa Mortgage the largest mortgage broker in the country has simplified the process of finding you the right lender for you and your familys dream home. Visit the Find a Loan Officer tab to contact a loan officer in your area.

FHA defines a manufactured home as a structure that is transportable in one or more sections. But even the VA wont go past 100 loan-to-value LTV to cover the purchase price of your home. 25 years for a loan on a multi-wide manufactured home and lot.

Rates shown include up to 25 discount point. Finding a manufactured home loan does not have to be difficult. Department of Housing and Urban.

These limits typically change annually so make sure to find the most recent FHA loan limits by county on the HUD website External link opens in new tab. These loan officers can help you find out more about CalHFAs programs and guide you through the home buying process. They have historically allowed lower-income Americans to borrow money to purchase a home that they would not otherwise be able to afford.

The maximum term is 15 years for a lot-only purchase. If you are a homebuyer please have your loan officer walk through this with you. An FHA loan wont finance more than 965 and a conventional loan wont surpass 97 of the homes value.

It is possible to get a traditional home mortgage such as an FHA loan or a VA. Yes FHA has financing for mobile homes and factory-built housing. Use this calculator to compare CalHFA loans.

The banking institutions which will mortgage a manufactured home-with land attachment are likely to consider the exercise a high risk and will therefore reflect that risk with an inflated. We have two loan products - one for those who own the land that the home is on and another for mobile homes that are - or will be - located in mobile home parks. That term can be extended up to 25 years for a loan for a multi-section mobile home and lot.

Land and Home Real Estate Loans Refinances Purchase Money Conventional FHA VAFHA 203k rehabilitationLoans for any age pre-HUD homes older than 1977Loans for manufactured home multi-family propertiesReal Estate 433A conversions programs Construction Real Estate Loans Available as FHAVA and USDAPermanent Loan is closed before construction begins. Many types of properties may be purchased with an FHA insured mortgage including manufactured homes multi-family units and condominiums. Many first-time homebuyers may find the best loan optionssome even offering 100 financingthrough government-backed loan programs like the Federal Housing Administration FHA Department of Veterans Affairs VA.

All FHA loan have PMI for the life of the mortgage which is reflected in the APR. Current FHA loan limits vary by location based on home prices. Another low-down-payment mortgage option is the FHA home loan for which 35 down is acceptable.

The limit in low-cost counties is 331760 and rises to 765600 in the most expensive counties. This is generous compared to most mortgages. Minimum down payment is 35.

Although you may hear about FHA loans to buy mobile homes the term mobile home was often used when referring to homes built prior to June 15 1976 before the US. FHA Loan Rules for Down Payment Gift Funds. But keep in mind that you would have to refinance in order to use the 203k loan on a.

There are many different types of FHA loans available for borrowers who want more options than a typical suburban home. How about manufactured housing and mobile homes. Final loan figures may be.

All loans are subject to borrower meeting FHA approval guidelines. This tool is for estimation purposes only. This tool is intended for loan officers and lending partners.

Being able to compare qualified mobile home modular home or manufactured home lenders has never been easier. FHA loan income requirements. FHA loans are designed for low-to.

FHA LOAN MAXIMUMS FOR MOBILE HOMES MOBILE HOME LOTS AND HOME-AND-LOT COMBINATIONS There are FHA loan maximums for mobile home loans up to just under 93 thousand for a manufactured home. It can be very difficult to qualify for a home equity loan if you are using a manufactured home as collateral. The bottom line is that if you want to own a home a manufactured one might be the way to go.

Many banks simply wont mortgage or loan on a titled manufactured home and virtually none will if the manufactured home has no land attachment. An FHA loan is a mortgage issued by federally qualified lenders and insured by the Federal Housing Administration FHA. FHA mortgage insurance protects lenders against losses.

Ask an FHA lender to tell you more about FHA loan products. 15 years for a manufactured home lot loan. An FHA manufactured home loan is a mortgage insured by the Federal Housing Administration FHA to purchase homes built in a factory.

The demand for mobile home equity lines of credit and loans has surged in 2020. FHA insures mortgages on single-family multifamily and manufactured homes and hospitals. An FHA insured loan is a US Federal Housing Administration mortgage insurance backed mortgage loan that is provided by an FHA-approved lender.

If your repairs are on a single-family home and are going to cost more than 25000 the FHA offers 203k loans that allow you to borrow up to 35000 for short-term home repairs and up to 110 of the homes value after the repairs are completed for more substantial repairs. The payment amount does not include homeowners insurance or property taxes which must be paid in addition to your loan payment. August 28 2022 - Borrowers wishing to purchase a home with an FHA loan may need some help with the down payment.

A manufactured home is a mobile home built after 1976 that has HUD tags to show its compliance with modern codes. Term is typically 20 years.

1 Manufactured Home Loan Calculator How Much Can You Afford Manufactured Nationwide Home Loans 1 Manufactured Home Loan Lender In All 50 States

Ultimate Guide To Manufactured Homes Forbes Advisor

How To Finance A Mobile Home Nextadvisor With Time

Delaware Manufactured Home Loans Prmi Delaware

Manufactured Home Loans Arkansas Federal Credit Union

Manufactured Homes Offer Relief As Affordability Squeeze Tightens Bankrate

Financing Mobile Manufactured Homes Fha Usda Programs

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Facts About Fha Manufactured Homes Loans

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

100 Va Manufactured Home Loans Top Rated Local Lender Va Nationwide Home Loans 1 Va Home Loan Lender All 50 States Vanationwide Com

Fha Rules For Manufactured Modular Homes

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

1 Manufactured Home Loan Calculator How Much Can You Afford Manufactured Nationwide Home Loans 1 Manufactured Home Loan Lender In All 50 States

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

1 Manufactured Home Loan Calculator How Much Can You Afford Manufactured Nationwide Home Loans 1 Manufactured Home Loan Lender In All 50 States

Can I Get An Fha Loan For A Mobile Home